Futures Market: Last Friday night, LME copper opened at $9,411/mt, initially trading steadily before surging to a high of $9,507/mt mid-session. It then pulled back to a low of $9,388.5/mt, forming an "inverted V-shape." By the session's end, it slightly rebounded and closed at $9,440/mt, up 1.63%, with a trading volume of 33,000 lots and an open interest of 281,000 lots. Meanwhile, the most-traded SHFE copper 2503 contract opened at 77,360 yuan/mt, initially fluctuating upward to a high of 77,950 yuan/mt mid-session. It then fluctuated downward, hitting a low of 77,220 yuan/mt near the session's end, before slightly rebounding to close at 77,410 yuan/mt, up 0.89%, with a trading volume of 47,000 lots and an open interest of 177,000 lots.

[SMM Copper Morning Briefing] News: (1) Fed Chairman Jerome Powell will attend congressional hearings this week. According to the Fed's announcement on Thursday, Powell will testify before the Senate Banking Committee at 10 a.m. (EST) on Tuesday and before the House Financial Services Committee the following day. Notably, this will be his first questioning by Congress since July last year. The Fed cut interest rates by a total of 100 basis points in its last three meetings of last year. In January this year, the Fed voted to keep rates unchanged at the 4.25%-4.5% range. (2) In January, due to the Chinese New Year, the national CPI growth expanded, and core CPI, excluding food and energy prices, rose for the fourth consecutive month. Industrial production remained in the off-season, and PPI fell YoY, with the decline matching the previous month. On February 9, the National Bureau of Statistics (NBS) released data showing that in January 2025, the national CPI growth expanded, with MoM growth shifting from flat in the previous month to up 0.7%, and YoY growth widening from 0.1% to 0.5%. Core CPI, excluding food and energy prices, rose for the fourth consecutive month, up 0.5% MoM and 0.6% YoY, with both growth rates higher than the previous month.

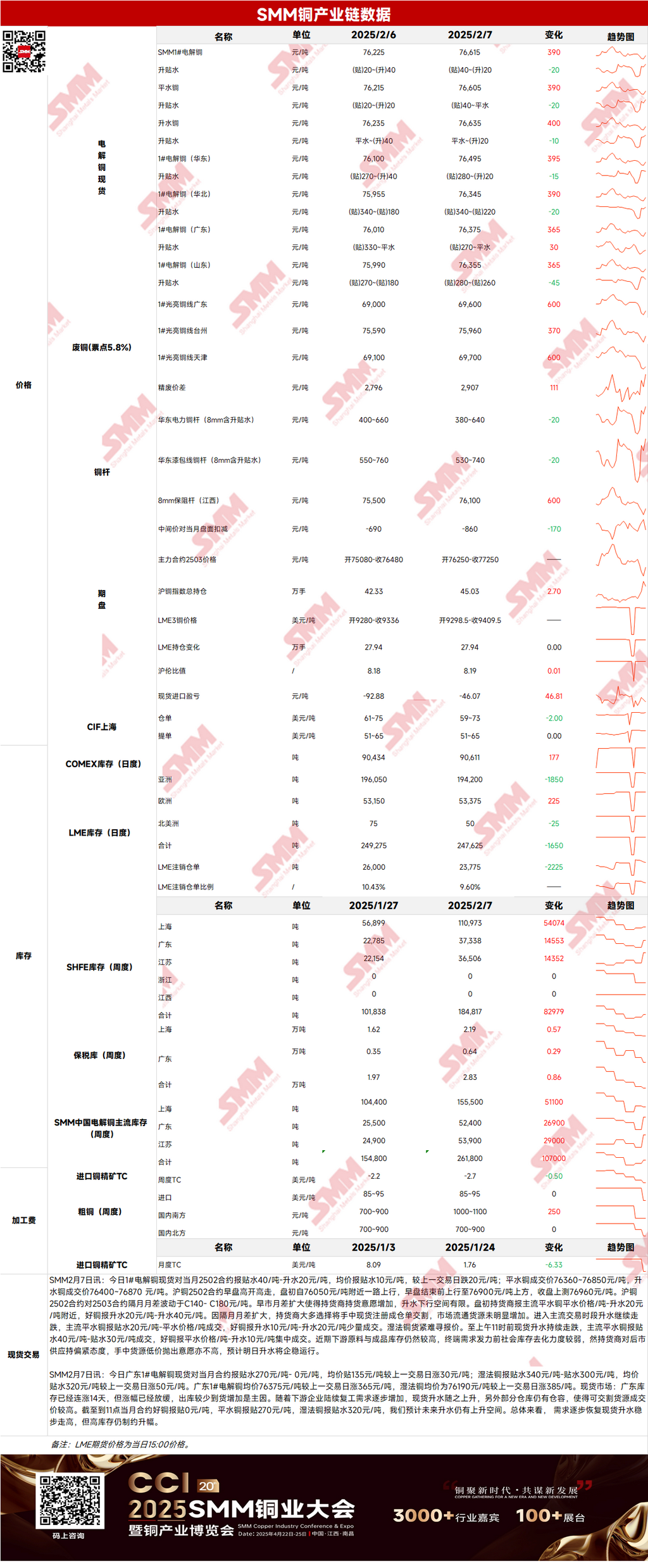

Spot Market: (1) Shanghai: On February 7, #1 copper cathode spot prices against the front-month 2502 contract were quoted at a discount of 40 yuan/mt to a premium of 20 yuan/mt, with an average price at a discount of 10 yuan/mt, down 20 yuan/mt MoM. Early in the session, the widening monthly price spread increased suppliers' willingness to hold goods. Recently, downstream raw material and finished product inventories remained high, and social inventory destocking was weak before end-use demand picked up. However, suppliers held a tight supply outlook for the future and were reluctant to sell at low prices. Spot premiums are expected to stabilize this Monday.

(2) Guangdong: On February 7, Guangdong #1 copper cathode spot prices against the front-month contract were quoted at a discount of 270 yuan/mt to parity, with an average price at a discount of 135 yuan/mt, up 30 yuan/mt MoM. Overall, demand gradually recovered, and spot premiums steadily increased, but high inventory levels limited the rise.

(3) Imported Copper: On February 7, warehouse warrant prices were $59-73/mt, QP February, with an average price down $2/mt MoM. B/L prices were $51-65/mt, QP March, with the average price flat MoM. EQ copper (CIF B/L) was quoted at $3-17/mt, QP March, with the average price flat MoM, referencing mid-to-late February port arrivals. Due to a weak SHFE/LME price ratio and incomplete recovery of downstream demand, warehouse warrant transaction prices fell in early-to-mid February. However, market interest in mid-to-late February B/Ls increased recently, and port arrivals are expected to be limited, keeping B/L prices firm.

(4) Secondary Copper: On February 7, secondary copper raw material prices rose 600 yuan/mt MoM, and Guangdong bare bright copper prices were 69,500-69,700 yuan/mt, up 600 yuan/mt MoM. The price difference between primary metal and scrap was 2,907 yuan/mt, up 111 yuan/mt MoM. The price difference between primary and scrap rods was 1,370 yuan/mt. According to the SMM survey, most secondary copper raw material yards in Dali, Guangdong, had not resumed operations. Interviewees indicated that traditionally, normal operations resume after the Lantern Festival (February 12). Therefore, secondary copper raw material supply will remain tight in the short term, with supply expected to increase after full resumption of operations.

(5) Inventory: On February 7, LME copper cathode inventory decreased by 1,650 mt to 247,625 mt. SHFE warrant inventory increased by 6,281 mt to 53,008 mt.

Prices: Macro side, the latest data showed that US seasonally adjusted non-farm payrolls in January recorded 143,000, significantly below the market expectation of 170,000, marking the lowest level since October last year. Although the US labour market slowed, it remained strong. Several Fed officials commented on monetary policy, indicating a low probability of interest rate cuts in the short term. Meanwhile, Trump announced that reciprocal tariff measures would be introduced this week, potentially increasing the US dollar's appeal and weighing on copper prices. Fundamentals side, downstream raw material and finished product inventories remained high, and social inventory destocking was weak before end-use demand picked up, entering an inventory buildup phase. However, suppliers held a tight supply outlook for the future and were reluctant to sell at low prices. Spot premiums are expected to stabilize. Price-wise, with Trump continuing to announce tariff policies this week and the release of US CPI data, the US dollar index may continue to rise, putting pressure on copper prices. Copper prices are expected to face resistance today.

Click to view the SMM Metal Database

[The above information is based on market collection and comprehensive evaluation by the SMM research team. The information provided is for reference only and does not constitute direct investment research advice. Clients should make cautious decisions and not replace independent judgment with this information. Any decisions made by clients are unrelated to SMM.]